How to Prepare Your Business to Withstand a (Potentially Upcoming) Recession

How to READY YOUR Company to Withstand a (Potentially Upcoming) Economic downturn

While unfortunate however, not unforeseen, some economists and watchers of the United states economic climate have recommended that the US could be headed for a economic downturn sometime in 2021. As a matter of known fact, some commenters possess categorically mentioned that the united states economy has already been in a recession. Therefore if one had been to combine both of these universities of thought it really is perhaps secure to infer that the economic downturn may only worsen in 2021 and beyond.

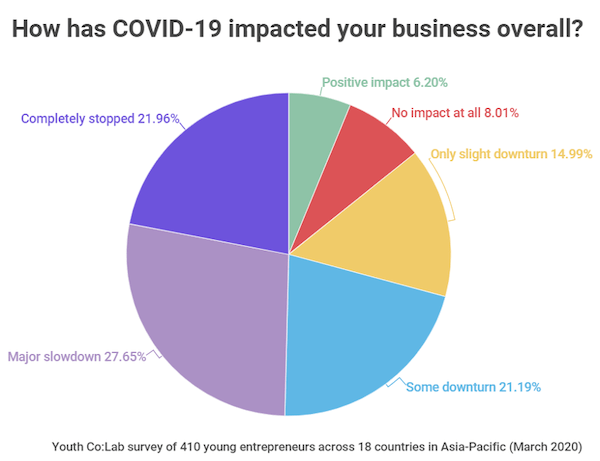

The foundation and reason behind this prediction isn’t too difficult to notice; the COVID-19 pandemic that devastated not only the United States, however the entire planet.

Sufficient reason for the economy and modern society rocked by medical crisis, we’re currently at a drawback. T he question after that will be what can be achieved to prepare for this? While it will be hoped that governments at all ranges will quickly take necessary actions reduce its influence on the economy, companies, can still go on it upon themselves to consider measures to cushion the result.

In this article, I’m likely to cover six methods to limit the effect of the potential following recession on your own business. But initial, lets go over the reality about recessions.

Exactly what is a economic downturn?

A economic downturn is described by the National Bureau of Economic Analysis (NBER) as “a substantial decline in economic exercise that is spread over the economic climate and lasts lots of months.”

Can the recession end up being predicted?

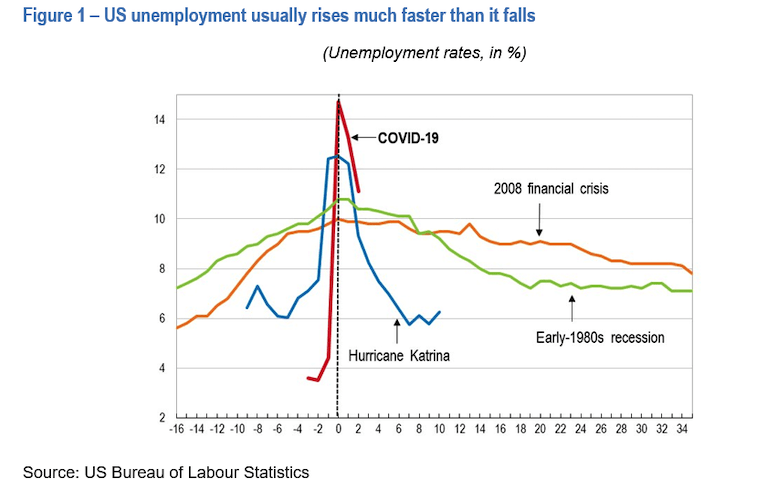

Because the very first economic downturn that was recorded in the usa in 1797, some reviews have it that there were as much as 47 recessions since. While recessions are usually an unavoidable reality of our lives, probably among the silver linings about them is usually that modern-time economists can now predict, with a higher diploma of certainty, the chance that a recession might occur in an economic climate. Perhaps the just unknowns about them are usually how long they’ll last and the severe nature with that they will happen.

The opportunity to predict the chance of a economic downturn happening implies that economies can much better prepare for them, possibly avert them, or at the very least minimize their results.

Perform recessions yield any advantages?

In just as much as recessions are generally recognized to have unwanted effects on economies, they’re not absolutely all about doom and gloom. For all your talk about their bad impacts on economies, companies, and people, recessions are also recognized to bring using them some positive items . Perhaps most importantly may be the correction that it brings to the machine.

6 ideas to limit the influence of the (potential) following recession on your company

While we can not control whether a economic downturn will take place, there are some actions you can take to increase your likelihood of surviving. In this area, I’m likely to go over how exactly to use business human relationships, diversification, cashflow, marketing, and even more to safeguard your business whenever you can.

1. Maintain, improve, and nurture company interactions

The bread and butter of any company is, certainly, the romantic relationships it has with different stakeholders which range from customers, creditors, providers, employees, and much more. How these associations could work towards helping your organization survive a economic downturn will differ, but whether separately or collectively, they are able to change lives.

For instance, your long-time, loyal clients will probably keep making use of your business, even though times are hard and you can find lower prices somewhere else; and good relationships together with your lenders and suppliers can provide you usage of vital credit lines or raw materials which may be required during crisis.

2. Diversify your offerings

Among the pillars of any prosperous business is its capability to diversify. Businesses that can master this artwork during periods of financial boom stand a larger potential for not being as significantly hit by way of a recession when compared to a mono-product or services company.

The reasons because of this are possibly easy to understand. A diversified business includes a diversified income stream. During recessionary occasions when certain varieties of services and products have a hit and visit a reduction in requirement, a company’s diversified item list means that a number of of its products could just be those that will continue steadily to generate income and keep the company afloat.

Put simply, don’t put all of your eggs in a single basket; you must have some agility so that you can adjust to changes in customer behavior and the economic climate.

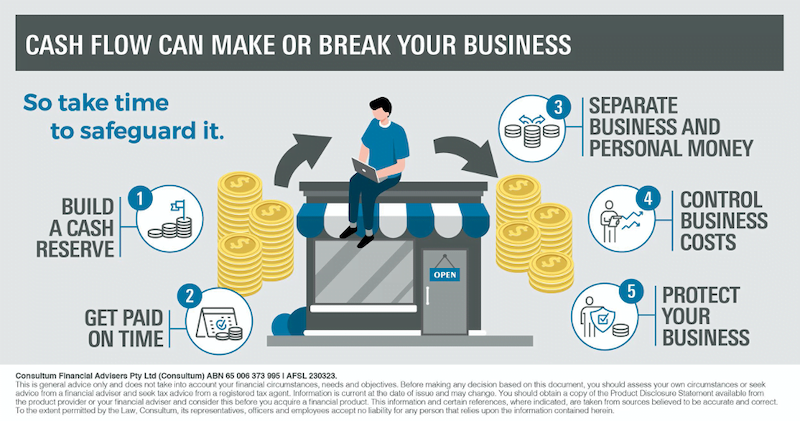

3. Protect your money stream

The money flow of a small business is essential to its survival and wellness. Your business’s cashflow can be kept optimistic by doing things such as being frugal together with your business’s costs, building and sustaining a wholesome cash reserve, ensuring your customers’ debt burden to your organization are met tend to be as possible, and much more. The flip part of this coin is equally essential; keeping all outgoing money flows from the business enterprise at the very least.

4. Maintain debt and expenditures to the very least

Financial debt is really a double-edged sword which you can use as an instrument for growth, but simultaneously it can end up being the foundation of one’s downfall or even managed properly.

When an economic climate is in great form, debt can donate to the development of a business in many ways. The other aspect of this coin and the unwanted effects of debt, specifically high degrees of debt, is necessary when an economic climate is experiencing a economic downturn. During these periods of reduced action, your business may not be generating just as much (or any) income and may consequently struggle to service your financial troubles when lenders come calling.

Some businesses have a getaway route if they did something as basic as shaped an LLC or any business entity that provides you the choice of filing for company bankruptcy, and therefore, exempts you from repaying the business enterprise debt. It is very important mention, however, there are occasions when that “‘business veil” will undoubtedly be pierced and you may personally be held responsible for your business’s financial debt.

5. Continue advertising

It really is quite logical for some business owners to avoid their marketing routines whenever there exists a downturn throughout the market and their businesses. Nevertheless, unconventional wisdom advises us that instead of completely ceasing your advertising activities throughout a recession, you will end up much better off by continuing to advertise it , or at the minimum scaling it back again a little, but in no way to the main point where it stops totally. Also, as essential as marketing would be to the survival of one’s business, so are also the other assets that can help to cultivate your organization both pre and post-pandemic.

The thinking behind that is simple. Once you (continue steadily to) invest in marketing and advertising that educates and informs your present and potential clients on what they can get yourself a better bang for his or her buck, and how your service or product can match their needs at the same time when they want to create informed changes with their investing or buying habits, they will probably continue supporting your organization.

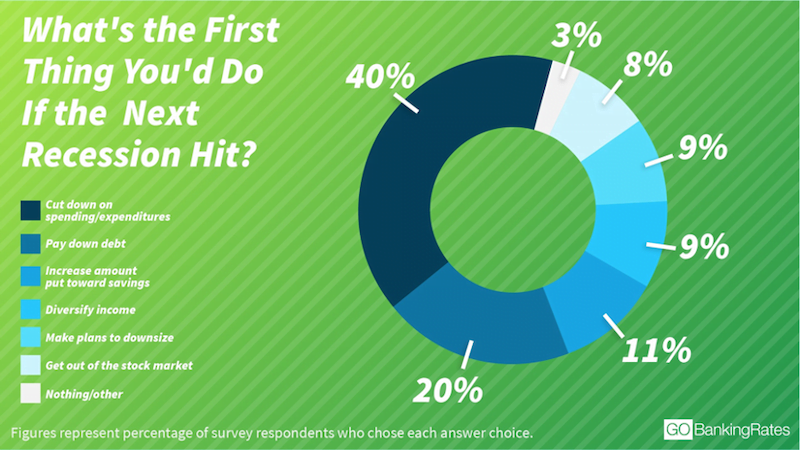

Image supply: GOBankingRates

6. Maintain your workforce minimal

Needing to lay off your workforce is among the hardest items that you’ll ever want to do as a business proprietor. The feeling will undoubtedly be very much worse if these workers have families that be determined by them and the revenue they earn from your own business is because of their livelihoods.

Yet, throughout a economic downturn and the downturn running a business activities, this is just what you may want to do, specifically if most of the items that have been talked about in this article haven’t been completed.

It really is, therefore, essential that you continue to keep your workforce at the barest minimal all the time. Just because your organization is doing properly is no reason to be on a employing spree. And when you totally must hire more employees, perhaps you should 1st consider hiring part-time employees of freelancers. Doing this will mean your staff level will undoubtedly be at a far more manageable one, and throughout a recession, you won’t have got a bloated workforce. In that situation, you just may be better in a position to keep them utilized, even if at a lower life expectancy pay rate.

On your final note, it really is noteworthy to say that whenever you use part-time workers or freelancers, it is very important ensure that a good agreement is drafted by way of a good business lawyer to ensure that your organization is correctly protected from all types of situations which could potentially occur such settings.

Plan a potential economic downturn with one of these tips

In the same way you can find no guarantees in lifestyle, taking the above-listed steps will not guarantee that your company will come from the recession scot-free, nonetheless it may reduce its negative impacts on your own company. To recap, here’s what we discussed:

- Maintain, enhance, and nurture company human relationships

- Diversify your offerings

- Protect your money circulation

- Keep financial debt and expenses to the very least

- Continue advertising

- Maintain your workforce minimal

In addition to the risk of a economic downturn, the points mentioned previously also lead to good business feeling and when implemented have the possible to help take your organization to greater heights throughout a booming economic climate.

Concerning the author

Kanayo Okwuraiwe may be the founder of Telligent Advertising LLC, an electronic marketing company that delivers lawyer SEO providers to help lawyers grow their procedures. Connect to him on Linkedln .